Memory Apocalypse: How the Surge in AI Demand Is Rapidly Driving Up the Cost of PC RAM and SSD Storage

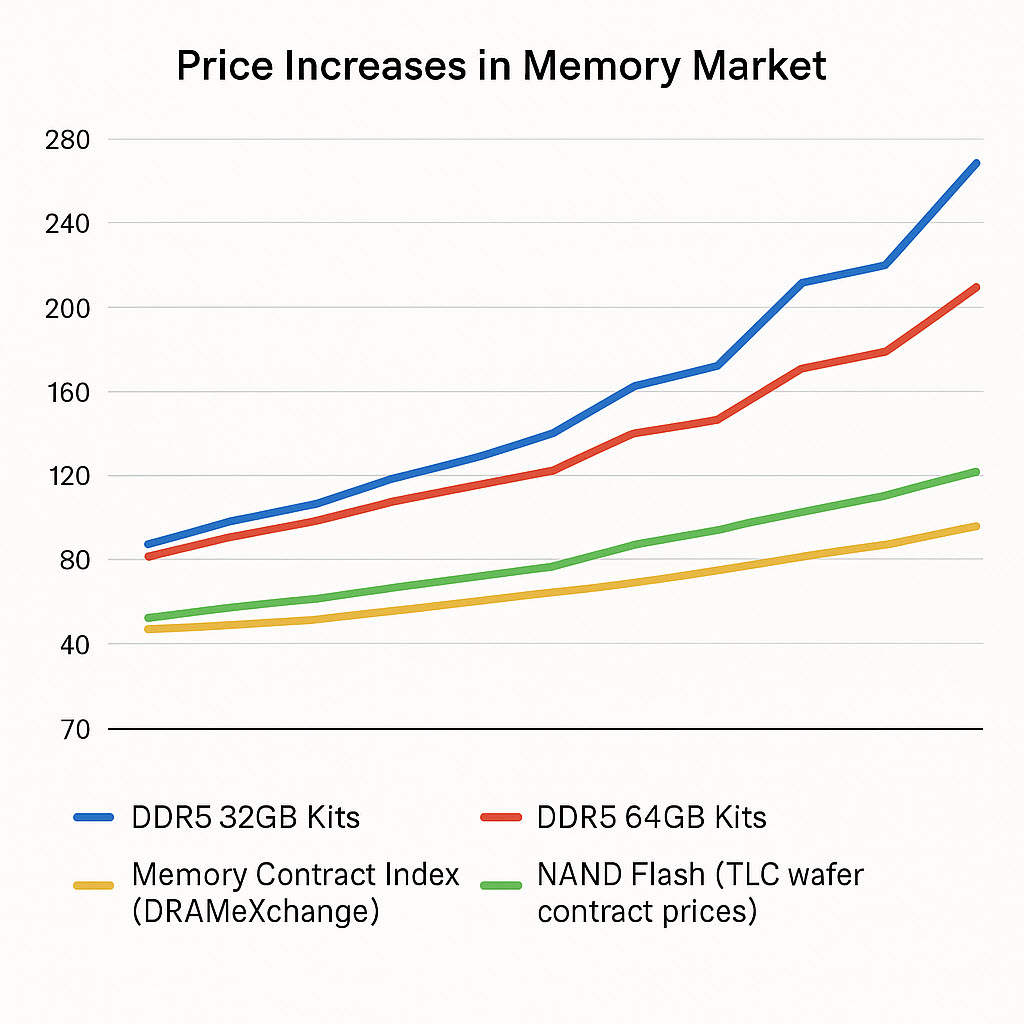

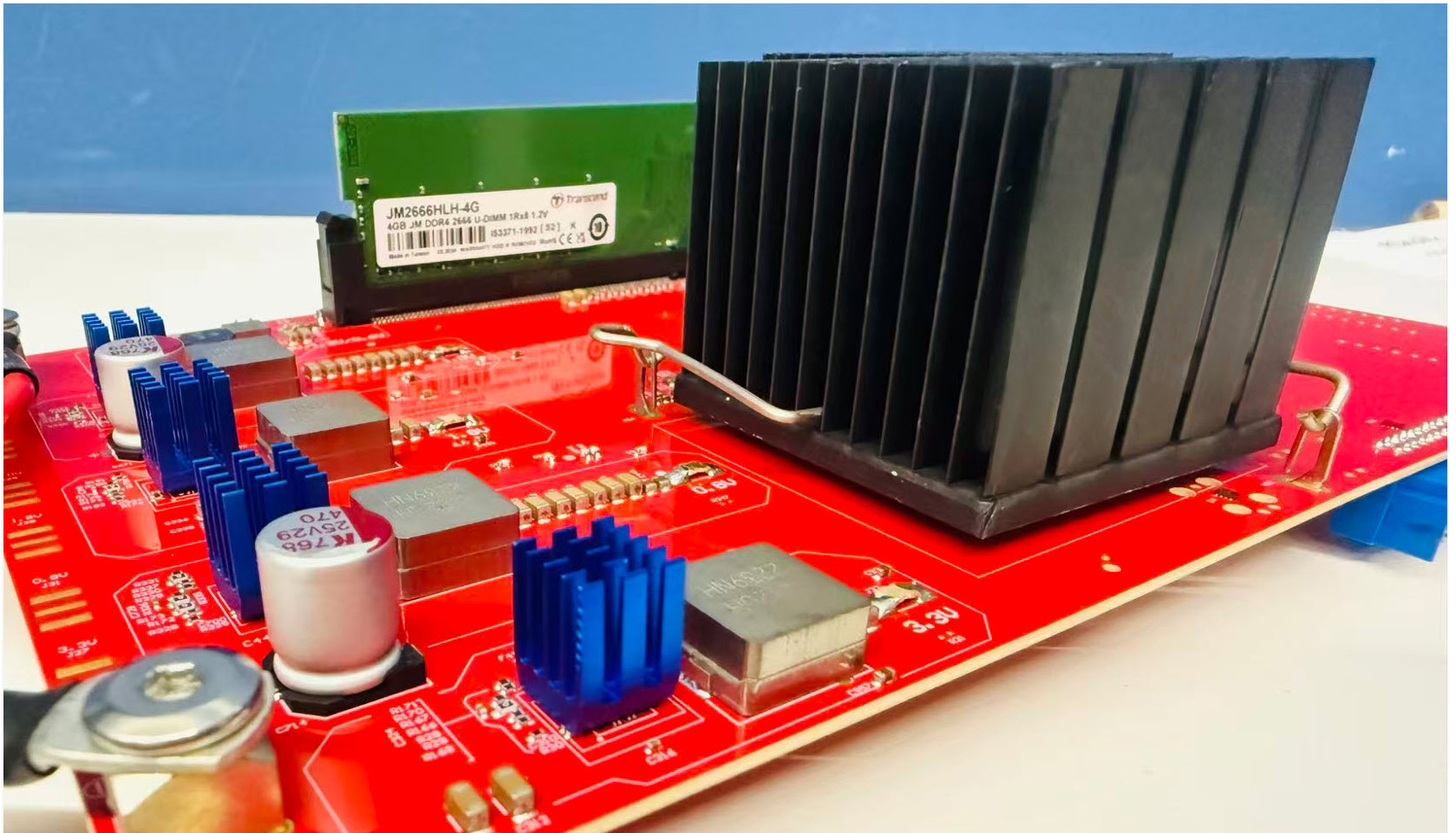

The so-called “memory apocalypse” is hitting the PC world like a bad hangover, and it’s showing up everywhere—from empty motherboard aisles to gamers quietly shelving their upgrade plans. Motherboard sales in key markets have fallen by as much as 50%, and the blame lands squarely on exploding DRAM prices. Enthusiasts who planned full new rigs are now downsizing or simply waiting it out because DDR5 kits that were around $79 not long ago are now pushing $140, while 64GB kits routinely sail past $250. Industry trackers show contract memory pricing climbing hard quarter over quarter, and NAND flash wafers used in SSDs are up sharply year over year, pushing SSD prices 20–30% higher and taking the fun right out of “I’ll just add more storage.”

Underneath all this, the villain wearing the expensive suit is AI. Training massive language models, recommendation engines, image generators, and all the other buzzword machines takes a stupid amount of memory. We’re not talking about a couple of DIMMs in a gamer box; we’re talking about racks of servers loaded with high-density DRAM and stacked with ultra-fast NAND-based storage. Nvidia GPU clusters need mountains of memory to keep those accelerators fed, and hyperscale players like Microsoft, Anthropic, and every cloud provider with an AI slide deck are placing orders measured in tens or hundreds of thousands of high-capacity modules. That demand doesn’t just nudge the market—it steamrolls it.

When Samsung and SK Hynix look at that firehose of data center demand, they don’t rush to flood the market with cheap chips. Instead, they “optimize capacity” and “minimize oversupply,” which is corporate-speak for keeping the supply tight and the margins fat. The same logic slams into NAND: AI workloads chew through enormous SSD farms for training data, checkpoints, and logs, so TLC and QLC wafers get bid up before consumer drives ever see them. The end result is simple: data centers get first dibs, and the rest of us pay what’s left over. That’s how you end up with SSDs that cost more this year than last, even when nothing about your gaming rig got any smarter.

The domino effect is brutal. When RAM gets too expensive, nobody buys motherboards. When motherboards sit on shelves, CPU sales stall. GPU deals suddenly don’t look like deals at all, and gamers end up spending their money on cheaper toys like mice, keyboards, and new monitors because at least those don’t require a second mortgage. Even Black Friday couldn’t disguise the mess, with GPU and memory pricing mostly shrugging at the idea of “sale season.” If the current forecasts hold, this memory crunch could stretch into 2028, leaving PC builders tiptoeing around upgrades and nursing a long, ugly DRAM and NAND hangover while the AI giants happily drain the global supply.

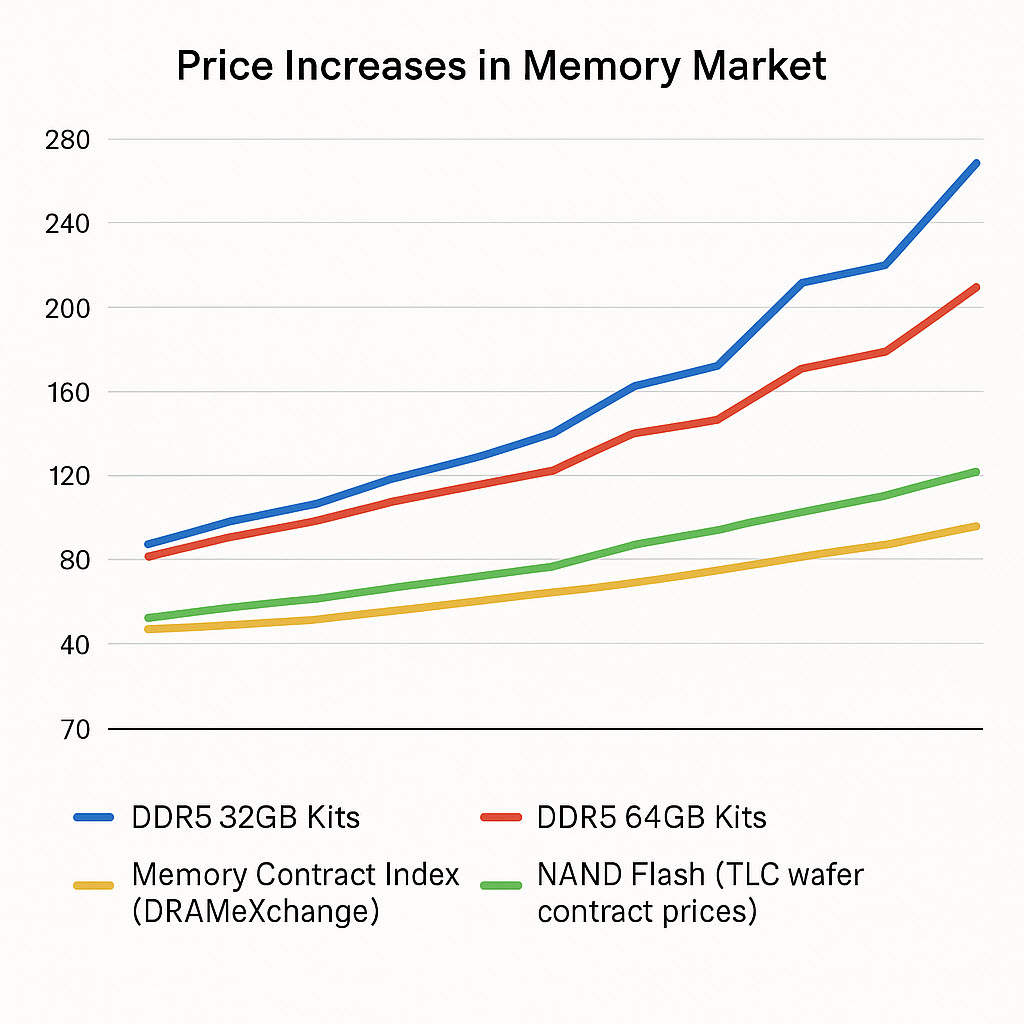

Rising Memory Costs Across DDR5, NAND, and Contract Markets

This chart shows (Q4 – 2025) how memory prices have surged across the board, with DDR5 32GB and 64GB kits climbing the fastest over the past several months. Industry contract pricing has also moved upward, including DRAMeXchange’s Memory Contract Index and TLC NAND wafer prices. Together, these trends highlight broad market pressure driven largely by soaring AI demand, supply tightening, and renewed data center spending.